how to check unemployment tax break refund

Search results are sorted by a combination of factors to give you a set of choices in response to your. Another way is to check your tax transcript if you have an online account with the IRS reports CNET.

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

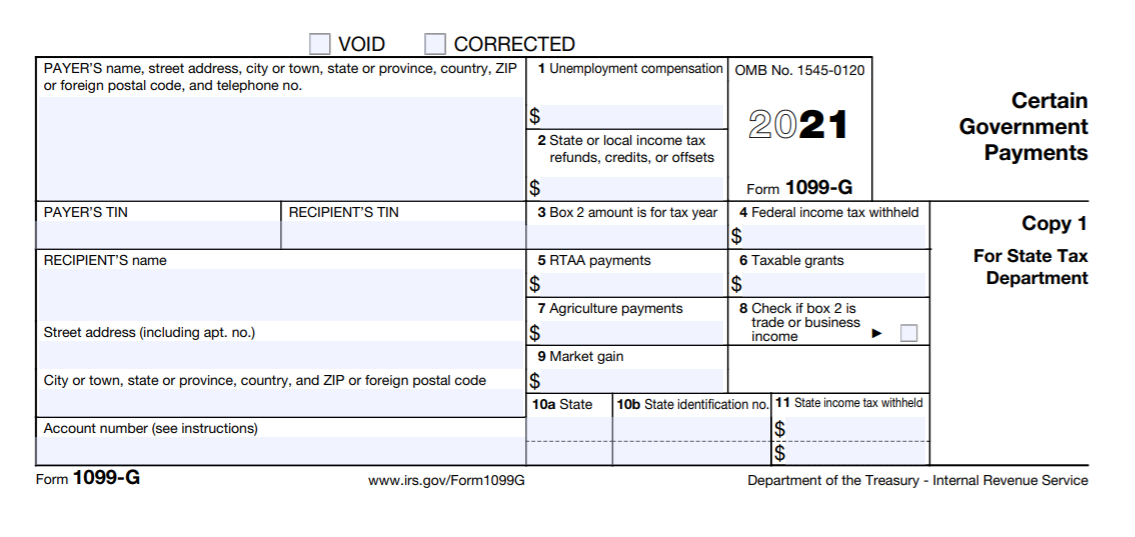

On Form 1099-G.

. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. In Box 1 you will see the total amount of unemployment benefits you received. Taxpayers can find out if and when their refund was mailed and when they.

View Refund Demand Status. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The deadline for filing your ANCHOR benefit application is December 30 2022.

Go to My Account and click on. How To Track Your Refund And Check Your Tax Transcript. Oscar Gonzalez 1122021.

In Box 4 you will see the amount of federal income tax that was withheld. This is available under View Tax Records then click the Get Transcript. SuperPages SM - helps you find the right local businesses to meet your specific needs.

We will begin paying ANCHOR. The first way to get clues about your refund is to try the IRS online tracker applications. For paper filers the IRS.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to. The Automated Refund Inquiry System provides more extensive information about the status of State tax refunds. View Refund Demand Status.

Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to. The IRS has sent 87 million unemployment compensation refunds so far. Go to My Account and click on.

Property Tax Relief Programs. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. The IRS has sent 87 million unemployment compensation refunds so far.

One thing to keep in mind however is that SSDI and.

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

2020 Unemployment Tax Break H R Block

Interesting Update On The Unemployment Refund R Irs

When Will Unemployment Tax Refunds Be Issued King5 Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Unemployment Benefits In Ohio How To Get The Tax Break

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Issues More Tax Refunds Relating To Jobless Benefits

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Stimulus Check Update When Will Plus Up Covid Payments Arrive